Medicare! What an exciting topic! Whether you’re researching Medicare for a class paper or you’re a Bernie Bro who decided they should know something about Medicare before proclaiming it should be “for all” this blog post has all the information you need. If you’re getting ready to assist a grandparent with Medicare’s Open Enrollment Period, this post has six tips to help you get through open enrollment with your sanity (mostly) intact. If you can stand a dry sense of humor and bad political puns, I’ll do my best to keep you entertained while you suffer through understanding Medicare.

What is Medicare, Simply Please.

In the most basic sense, Medicare is the federal health insurance program for people age 65 and older. Younger individuals who are receiving Social Security Disability Insurance (more on this wildly interesting program coming soon) can also receive Medicare. Medicare is broken up into four parts with each part providing coverage for specific medical needs. Attempting to understand how the distinct parts of Medicare interact with each other, what coverage options are, how copayments work and what plan provides the best value for an individual’s specific situation has been shown to cause nausea, vomiting, headaches, watering eyes, and diarrhea – but big pharma is working on a pill for that which will likely be covered by Medicare Part D. Continue reading at your own risk.

🎉 Congrats! You made it through the easy stuff. 🎉

If you must keep going, I recommend fixing yourself a drink; it will make the rest of this article easier to tolerate. A few caveats, because we can’t have an article about Medicare without Medicare-esque caveats: While reading the rest of this post, should you suffer light-headedness or faintness of breath, go stretch and walk around until feelings of discomfort subside. Fret not, Medicare will still be here when you get back; mostly because Trump can’t get rid of it with a Tweet.

Into the Nitty Gritty of Medicare.

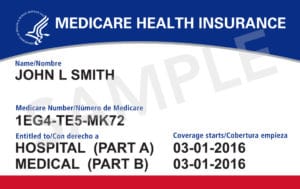

The four parts of Medicare are referred to by letter, with the first two parts (Parts A and B) of Medicare being administered directly by the government. The latter two parts (which you should be able to figure out by process of elimination) are operated by private insurance companies. Together, Medicare Parts A and B make up what is commonly referred to as “Original Medicare.” Original Medicare is a fee-for-service program meaning the government pays a fee for each service a beneficiary is provided.

Medicare Part A

Medicare Part A covers hospital stays, care in a skilled nursing facility, hospice care and just enough of home health care to make it annoying, but not enough to be helpful. Unless the GOP gets its way, individuals who have paid 10 years of Social Security taxes, don’t pay premiums for Part A coverage. While that sounds like free healthcare, it’s really not.

Medicare Part A Isn’t “Free Healthcare”

Medicare only pays 80 percent of most covered services leaving individuals to pay the remainder of the bill using their own funds. Services covered by Medicare Part A are not cheap and 20 percent of any medical bill can quickly become overwhelming – let’s look at an average hospital stay as an example. Currently, the average cost of a hospital stay is around $12,500 meaning grandma will be paying $2,500 out-of-pocket to cover one hospital visit. But the bills don’t end there with deductibles and coinsurance provisions quickly piling on additional out-of-pocket expenses.

For each “benefit period” a Medicare beneficiary will pay a deductible, which is currently $1,316. In case you’re wondering, a “benefit period” begins on the day of admission for an inpatient stay and ends once 60 days have elapsed with no inpatient stays. Inpatient stays lasting longer than 59 days are subject to a coinsurance payment of $329 per day. Inpatient stays lasting longer than 90 days will have a coinsurance payment of $658 per day and they’ll also be eating into what Medicare calls “lifetime reserve days.” Each Medicare beneficiary has 60 of these “lifetime reserve days.” These days are only used once a person has had more than 90 days of inpatient care. Should a person receiving inpatient care for more than 90 days, and eat through all of their “lifetime reserve days” they are responsible for the full cost of their care with no caps on out-of-pocket expenses. But, wait, Obamacare put caps on out-of-pocket expenses, right? Nope.

While the Affordable Care Act, also known as Obamacare, put annual out-of-pocket caps on insurance policies, that didn’t apply to Medicare Part A. So if you’re thinking to be on Medicare means seniors aren’t in jeopardy of declaring bankruptcy because of medical bills you’re wrong. Since bankruptcy sucks, many people on Original Medicare purchase Medigap Plans help them cover the costs Medicare leaves them to pay out-of-pocket. More on Medigap a bit later.

Feeling sick yet? Hold on tight, we’ve got three more parts of Medicare to go!

Medicare Part B

Need an ambulance ride. It’s covered by Medicare Part B. As are doctor visits, outpatient care, lab tests, durable medical equipment, mental health care services, X-rays, and preventive medical services. Unlike Part A benefits, there aren’t asterisks and fine print behind the dollar amount for each service. Seniors pay monthly premiums for Part B coverage, and those premiums are based on their income. As of this writing, premiums were $134 per month for individuals filing a tax return of $85,000 or less. The full table is here on the off chance you’re curious – or in need of some additional reading that will put you to sleep.

Okay, that rounds out the Medicare benefits which are directly administered by the federal government. Here comes the stuff that’s delivered by private insurance companies. If you’re thinking the efficiency of the private market has made Medicare Part C and D less of a mess, you’re about to be sorely disappointed.

Medicare Part C

Medicare Part C is commonly referred to as Medicare Advantage. If you’ve ever watched a channel old people tend to watch (say, CBS) in the fall, you’ve probably heard a ton of ads for Medicare Advantage Plans. Medicare Part C allowed private insurance companies to provide Medicare benefits to seniors. While plans must offer the same benefits as Medicare Parts A and B, they can do so with different rules, costs and coverage restrictions. Typically, Medicare Advantage Plans will provide benefits beyond what Original Medicare provides. Plans often cover dental, hearing, vision services and usually offer a cap on out-of-pocket expenses. In that regard, they’re better than Original Medicare. Of course, you need a cloud to have a silver lining.

By law, Medicare Advantage Plans cannot turn down any Medicare-eligible enrollee – however, since sick people eat into profit margins, private insurers structure copayments and deductibles to discourage those profit sucking seniors from joining their plans. Medicare Advantage plans are often accused of hiding the limitations of their plans from enrollees with most enrollees only finding out about the limitations of their plans after they’ve gotten sick and need that insurance. That’s a pretty dark cloud, eh?

By law, Medicare Advantage Plans cannot turn down any Medicare-eligible enrollee – however, since sick people eat into profit margins, private insurers structure copayments and deductibles to discourage those profit sucking seniors from joining their plans. Medicare Advantage plans are often accused of hiding the limitations of their plans from enrollees with most enrollees only finding out about the limitations of their plans after they’ve gotten sick and need that insurance. That’s a pretty dark cloud, eh?

Additionally, Medicare Advantage Plans limit beneficiaries to using health care providers that are “preferred” or “in network” and can change preferred providers at any time. This means if the insurance company and the doctor quit playing nicely together, a Medicare Advantage Plan beneficiary could end up not being able to see their preferred doctor.

Medicare Part D

Medicare Part D provides prescription drug benefits which were not included in Original Medicare. Prior to Medicare Part D’s enactment into law in 2003, and implementation in 2006, seniors on Original Medicare paid full price for their medications. Through Part D, the government subsidizes the cost of prescription medications. Individuals who have enrolled in Original Medicare will often opt for a stand-alone Part D plan, while most Medicare Advantage Plans will offer prescription drug benefits.

Medicare Supplement Policies

Commonly referred to as Medigap coverage, these policies are offered by private insurers to fill in the holes in Original Medicare. There are 10 types of Medigap plans, and because someone at the Centers for Medicare and Medicaid Services apparently only knows letters, the plans are labeled Medigap A through N. Because having Medigap Plan F as a supplement to Medicare Part A, is descriptive and just easy to remember. Or wait, was it Medigap Plan C the high deductible one grandma wanted… I digress.

Each letter variant of Medigap coverage must offer the same benefits, regardless of the private insurance company writing the plan. That should make things simple, right? Nope. This is Medicare. Since the private companies can’t compete on benefits, they compete on discounts, copayments, coinsurance costs and other things like offering a discount if you use electronic funds transfer to pay for premiums instead of a check or credit card. Given the very descriptive names of Medigap plans (😒) and all of the different ways private companies can write Medigap plans, it can be harder to find the right plan than it is for an ancillary character in Game of Thrones to stay alive.

Individuals with Medicare Advantage Plans cannot have Medigap coverage (lucky them); so if they are signed up for Medicare Advantage, there’s no need to be subjected to the torture that is Medigap Plan selection.

In this next section, we’ll talk about Medicare’s Open Enrollment Period (OEP). If you’re continuing on down the page, your teacher must have been in a terrible mood when they assigned this paper, or you’re the best grandchild ever for helping that important elder in your life figure out with this cluster of a federal benefit program.

Changing Up Medicare Coverage

Unlike private insurance, Medicare beneficiaries typically can’t change plans whenever they want. Thanks to Obamacare, you’re probably still on your parent’s health insurance, but if you’ve had the misfortune of purchasing your own health insurance through an employer, the concept of “open enrollment” going to be familiar to you.

Each year, the government offers a window where individuals can move from Original Medicare to a Medicare Advantage Plan, change Medicare Advantage Plans, move from a Medicare Advantage Plan to Original Medicare, add prescription drug coverage, change prescription drug plans or drop the drug coverage altogether. This window referred to as the Open Enrollment Period because calling it the “throw your dentures on the floor and stomp on them out of frustration period” just didn’t sound as good (although it’s probably more accurate). Open Enrollment runs from October 15 to December 7, each year, with new coverage beginning on January 1.

Handling Open Enrollment Without Using Medicare’s Mental Health Benefits

Need advice for getting through open enrollment period with minimum frustration? This post has you covered. Read on, Grasshopper.

1. Don’t Rush

This isn’t the YouTube comments section, and grandpa doesn’t get any notoriety for being first. But procrastinating making a decision, like putting off a term paper, is a terrible idea, too. Although I hear old people don’t have as much of a problem with procrastination – I guess I’m still too young to know this firsthand. While it might be tempting to “just get it over with,” making a quick decision can lead to inadequate coverage or being over-insured and paying too much in premiums.

2. Think Holistically

While it can be difficult to know exactly what healthcare will be needed during the coming year, if you are anticipating a major surgery or other large health expenses, it is a good idea to look for a plan that provides optimal coverage for your upcoming needs. Inversely, if a name-brand medication is becoming a generic, it might be a good idea to find a Medicare Part D or Medicare Advantage Plan that will help you save money with the generic (provided your doctor recommends switching to the generic).

3. Do Your Homework on Medications

Most Medicare Advantage plans will break medications into 5 tiers. These tiers are for preferred generics, other generics, preferred brand drugs, other brand drugs, and expensive specialty medications. The prices can vary wildly between these tiers and between plans. Before you pick a plan or an insurance provider, check to make sure your medications are covered and check different providers to see if they have your medications in a more favorable pricing tier. While this can be a time-consuming task, it helps save money on premiums.

4. Use Medicare’s Official Medicare Plan Finder

While there is no shortage of websites out there offering to help you find a Medicare plan, those websites can range from misleading to outright fraudulent. If you are unsure which website can accurately steer you toward a Medicare Plan that is right for you, use Medicare’s official Medicare Plan Finder located here. There are two versions of the tool. Using the “General Search” requires only a ZIP code, but will return less personalized information. Medicare’s “Personalized Search” requires a ZIP code, the beneficiaries Medicare Number, last name, date of birth and the effective date for their Part A coverage. As with all websites, make sure the URL bar shows a green padlock and says “Secure” before submitting any personally identifiable information.

5. Shop Medigap Plans if You Are Using Original Medicare

There are 10 types of Medigap Plans — Medigap A through N; however, not every letter is available in every state. Each letter variant is standardized, meaning every Medigap Plan written by a private insurer must follow strict federal and state standards; for example, Medigap Plan F is always the high-deductible plan regardless of the private insurer writing the policy.

On the surface, Medigap coverage may seem very straightforward; in practice, it is not. Private insurers may offer discounts on their plans if an individual is a nonsmoker or is married or opts to pay their premiums using electronic funds transfer instead of a check or debit card. Additionally, out-of-pocket limits, copayments and coinsurance rates can vary significantly between insurance companies offering Medigap plans. Moreover, Massachusetts, Minnesota, and Wisconsin have chosen to standardize their Medigap Plans differently than the rest of the country.

Given these variables and the sheer number of Medigap Plans, it can be challenging to find the best option. Fortunately, Medicare’s website provides a Medigap Policy Finder to help individuals using Original Medicare find a plan that fits their needs.

6. Enroll in Medicare Using Medicare’s Hotline, 1-800-MEDICARE

The best way to enroll in Medicare is to use the official enrollment phone number. Over the past few years, Medicare has increased staffing during open enrollment periods to avoid long wait times on the phone.

Once you reach a Medicare representative, take careful notes during your conversation, making sure to record any information the Medicare representative gives you during the call. You’ll also want to record the time and date you spoke with the representative, as well as the representative’s name.

Finally, before enrolling, go over all of the information with the representative one last time to make sure everything is accurate.

Final Thoughts

If you’re using the information in this post to write a paper, tweet at me and let me know if it was helpful (or even entertaining). If you’re helping someone make their way through open enrollment or enroll in Medicare for the first time and want to know what will likely provide the most coverage and flexibility without worrying about insane copays and out-of-pocket expenses, experts recommend Original Medicare with a Medigap Plan; so spend your energy researching Medigap plans. If you’re pro-Medicare For All, do us all a favor and get Medicare fixed before pushing us all onto it.

In all seriousness, I spent 5 years as a Field Representative for a United States Senator – during that time I had a lot of interaction with Medicare and health care policy. If you have questions, drop me a line. Medicare is an important federal benefit, and I’m always happy to help those who want to learn more about it or make it work better.